The business environment is in constant development, which involves changes in regulations, technology and globalization. We see an increased regulatory burden and supervision from authorities, which increases the demands of conducting licensed activities.

Overall, this trend leads to increased complexity and competition, new technological solutions and changed consumer behaviours. Prices are being squeezed for management-related services and the future of asset management is changing. Navigating this transition and maintaining regulatory compliance is challenging.

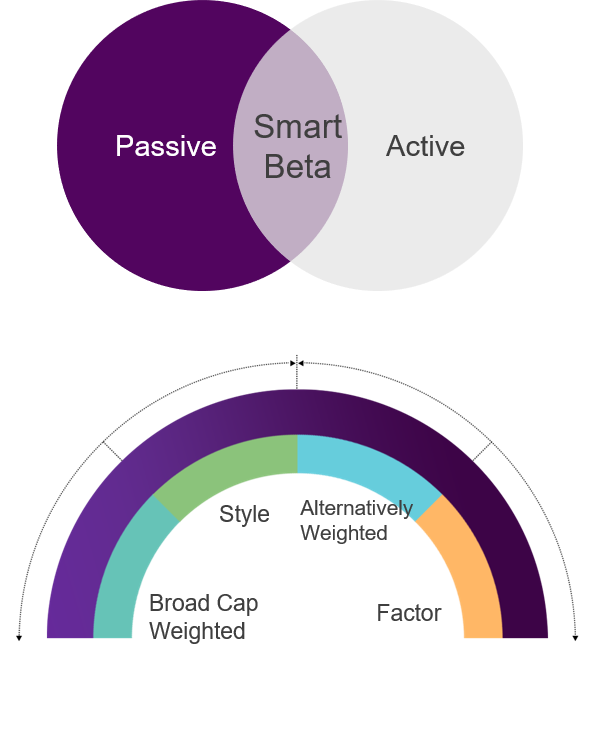

FCG Fund Management is a part of this development and can therefore offer our client’s a cost-effective asset management and/or trade execution. FCG Fund Management mainly works with structured asset management that is driven by index, risk or other weighting (i.e. factor).

FCG Fund Management have established relationships with most counterparties and have established DMA connections. We also support our customers with trade execution and advice.

The advantages are many with using FCG Fund Management for asset management or execution, for example:

- Economies of scale benefits and lower costs

- Efficient trading, pre- and post-trade compliance and associated administration

- No reporting (i.e. TRS)

- Utilization of established channels/counterparties and experienced portfolio managers

Do you have the potential to succeed in the future and how long can you wait?

Want to know more?

Why FCG Funds?

Competence and innovative

• Our ability to solve customer problems, regardless of complexity, and insight into their business creates a unique possibility.

• We have deep skills in all areas to set up and run fund business.

FCG Group

• The availability of our sister company, the Nordic region's leading consultancy in the financial sector, gives us access to skills and resources. We can thus help our customers to run their projects in land on time.

Complete solutions

• We provide a comprehensive solution for our customers and can help them with all the elements required to run financial activities. For example outsourcing, authorities, governance, processes, as well as risk, portfolio management, marketing & distribution and compliance.

License for all

fund types

• We have license permit for both securities-based and alternative funds.

• We can thus offer a wide range of funds that our customers need.

Local presence and operations

• We are local and based in Stockholm, Malmö and in Oslo. We believe that being local is key to be close to our customers.

• The FCG-Group has also offices in Copenhagen, Helsinki and in Frankfurt.