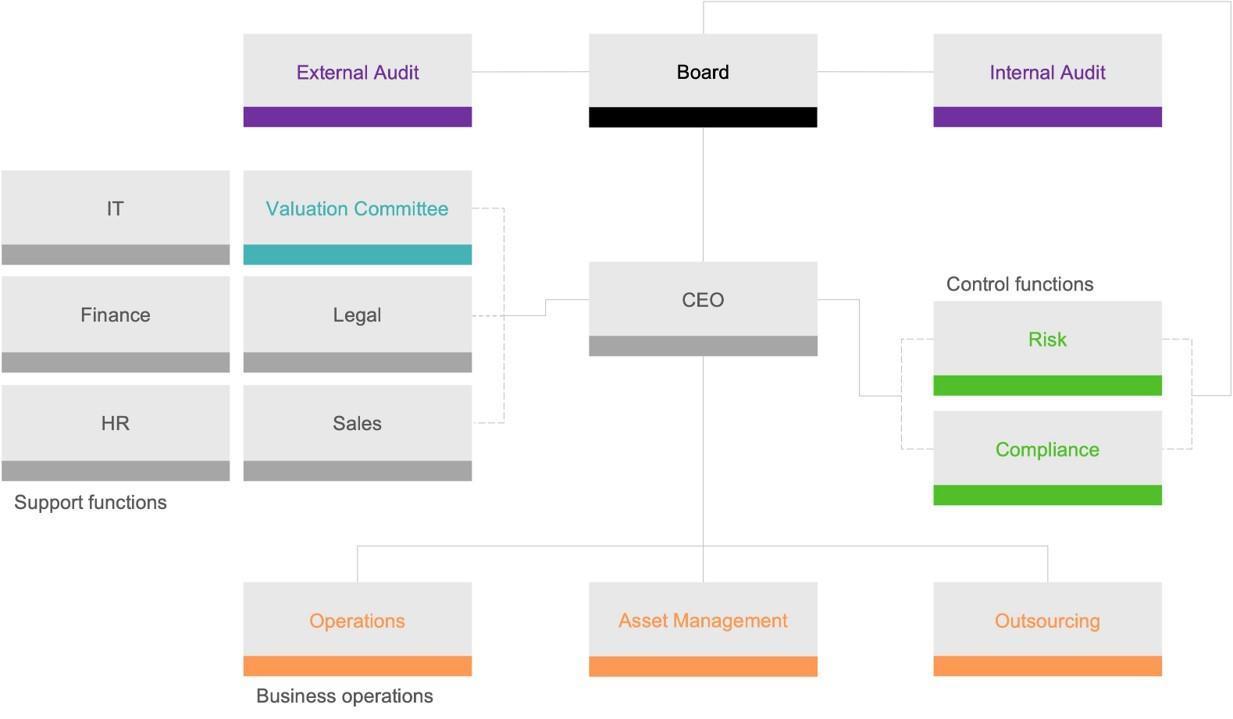

The objective of the FCG Fund Management AB’s system of governance is to organize its operations with regard to internal governance and control based on the principle of three lines of defence and to ensure efficient and adequate organization and management of the business. The three lines of defence cover the entire business. The company’s system for risk management and regulatory compliance covers all employees and outsourced operations and aims to manage risks in both FCG Fund Management and the funds managed by the company.

FCG Fund Management is independent in relation to other parts of the FCG Group. Among other things, the Board consists of three independent members to secure an independent business from the FCG group:

Carl-Viggo Östlund, former CEO of SBAB

Mari Thjømøe, Chair Of The Board Of Directors at BPT

Tove Bångstad, Head of Nordics at Amundi

FCG Fund Management believes that good internal governance and control comes from implementing awareness, duality and controls in the first line of defence.

The first line of defence is led by the CEO and consists of the business activities and support functions. The functions are fully responsible for the risks and regulation that their own operations encompass.

The second line of defence consists of the functions for risk management and compliance. The functions shall be responsible for conducting a risk-based operation that is based on annual plans for the respective function determined by the Board. The company’s independent risk management function has a central role in the Company’s risk management system. The independent risk management function focuses on monitoring, control, analysis, governance, reporting and advice on risk management.

The third line of defence consists of the function of internal audit. The function is both organizational and functional independent to the Company’s operational units and is directly subordinate to the Board. The internal audit function is responsible for examining and assessing whether the Company’s systems, internal control mechanisms and procedures are appropriate and effective and issue recommendations.

The Board of Directors has the overall and ultimate responsibility for ensuring that the entire business, including outsourced operations, is properly implemented according to established internal rules, applicable external rules and good industry practice.

The CEO is responsible for the operations as well as ensuring that the business is aware of, and the conditions for, complying with the Board’s current guidelines and rules, including outsourced activities.

Operations are responsible for the administrative activities related to the Company’s funds, which includes administration and control of portfolio transactions, subscription and redemption of units, valuation and NAV calculation, calculation of fees, management of cash and cash equivalents and accounting and reporting.

The Valuation Committee is a valuation function for the assets of AIF-based funds.

The Asset Management function is responsible for the management and distribution of the funds. The asset management function is primarily responsible for marketing, distribution, analysis of investments, investment decisions and execution as well as reporting.